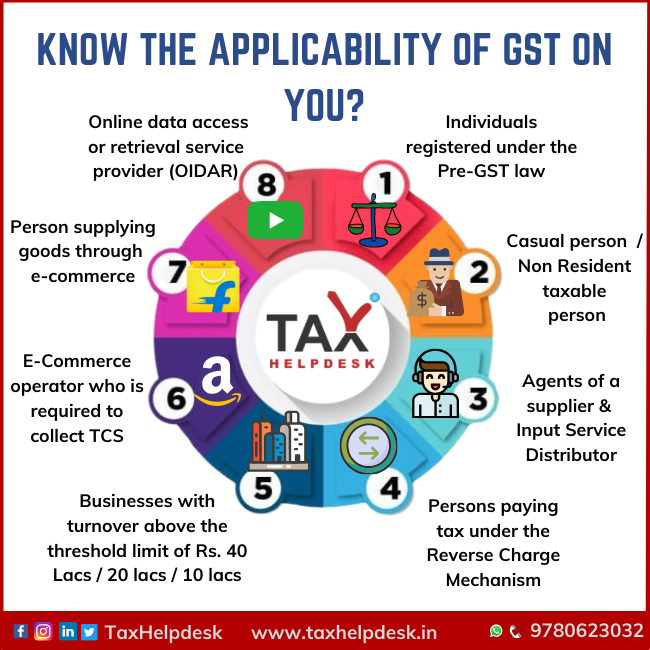

Goods and Services Tax (GST) has revolutionized the taxation landscape in India, simplifying the tax structure and bringing numerous benefits to businesses. GST registration is a crucial step for many businesses, providing advantages that go beyond mere compliance. Understanding how GST registration can benefit your business is essential for leveraging its full potential.

Streamlined Tax System

GST is designed to replace a complex web of indirect taxes with a single, unified tax structure. For businesses, this means fewer complications in managing tax obligations. Goods and Services Tax India integrates various state and central taxes into one, reducing the burden of dealing with multiple tax authorities and streamlining the tax process. GST registration ensures that your business operates within this simplified framework, making tax compliance more straightforward.

Input Tax Credit

One of the primary benefits of GST registration is the ability to claim Input Tax Credit (ITC). ITC allows businesses to offset the GST paid on inputs against the GST collected on sales. This credit mechanism can significantly reduce the cost of goods and services, leading to better cash flow and increased profitability. By registering for GST, your business can take full advantage of ITC, which is not available to unregistered entities.

Enhanced Business Credibility

GST registration enhances your business’s credibility and trustworthiness. Clients and suppliers often prefer dealing with GST-registered businesses as it signifies legitimacy and adherence to legal requirements. This can be particularly advantageous when bidding for contracts or establishing relationships with larger companies. GST consultation services can help ensure that your business is compliant and positioned well in the market.

Expanded Market Reach

GST registration allows businesses to expand their market reach beyond state borders. Under the previous tax regime, interstate transactions were subject to various taxes, leading to complications and higher costs. With GST, interstate sales are treated uniformly, facilitating easier and more cost-effective cross-border transactions. This creates fresh chances for development and commercial expansion.

Improved Compliance and Avoidance of Penalties

GST registration ensures that your business adheres to the legal requirements set by the government. Non-compliance with GST regulations can result in penalties, fines, and legal issues. By staying registered and compliant, your business avoids these potential pitfalls and maintains a positive standing with tax authorities. Regular GST consultations can keep you updated on compliance requirements and help manage your tax obligations effectively.

Simplified Tax Filing

Filing taxes under the GST regime is more streamlined compared to previous systems. The GST portal provides a centralized platform for filing returns, making the process more efficient. With GST registration, your business can benefit from a structured filing system, reducing the time and effort required for tax submissions. This efficiency translates to smoother operations and better resource management.

Better Business Planning and Forecasting

With GST registration, businesses gain access to comprehensive tax data, which aids in better financial planning and forecasting. Understanding your tax obligations and the benefits of ITC helps in accurate budgeting and financial management. This strategic advantage allows for more informed decision-making and effective resource allocation.

Access to Government Benefits and Schemes

GST-registered businesses are eligible for various government benefits and schemes designed to support and promote growth. These include subsidies, tax reliefs, and incentives that can provide a competitive edge. Being registered ensures that you can access these benefits and leverage them to enhance your business operations.

Conclusion

GST registration offers numerous advantages that can positively impact your business operations, from streamlined tax processes and improved compliance to enhanced market reach and financial benefits. By understanding the benefits of goods and services tax registration and leveraging goods and services tax India provisions, your business can thrive in a more efficient tax environment.

If you need assistance with GST consultation or have any tax-related queries, consult or contact TaxHelpdesk for expert support and guidance.