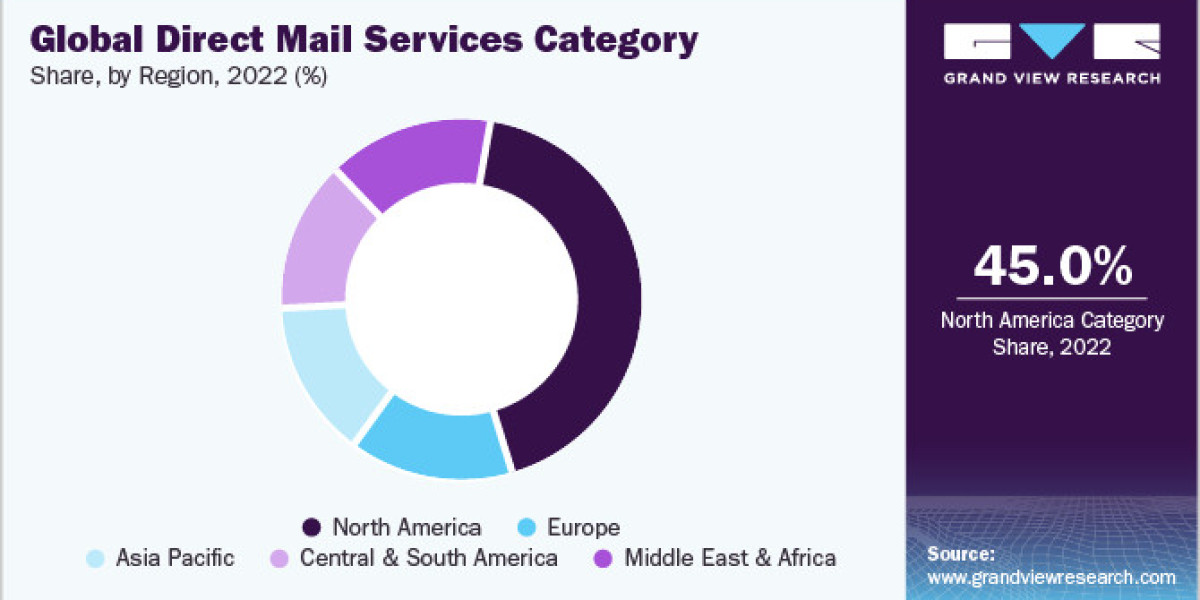

The direct mail services category is expected to grow at a CAGR of 3.1% from 2023 to 2030. As we move beyond the span of two complete years dealing with the pandemic, its far-reaching impacts have changed the direct mail industry. A noteworthy outcome is the growing reliance of numerous businesses on direct mail to attract, retain, and achieve outcomes. A key catalyst for this trend is the substantial change in how companies operate, with greater adoption of hybrid and remote work alternatives, which in turn has resulted in a rise in digital fatigue.

The significant influence of data analytics methods on direct mail is widely recognized. Through scoring models and segmentation strategies, the precise alignment of appropriate customers with tailored messages at optimal moments becomes achievable. This approach leads to a substantial decrease in inefficiencies and an increase in the return on investment for campaigns.

Direct mail is now far from being a solitary marketing channel with a single interaction. Increasingly, a direct mail campaign serves as a starting point for a comprehensive omnichannel experience. For instance, Personalized URLs (PURLs) unveil custom websites, Augmented Reality (AR) capabilities that blend the distinction between physical mail pieces and digital environments, QR codes that initiate promotional videos and exclusive phone numbers designated for arranging face-to-face appointments.

Order your copy of the Direct Mail Services Procurement Intelligence Report, 2023 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Improving campaign outcomes involves timing the messages accurately. Businesses can leverage the CRM data they have gathered to devise strategies for minimizing extensive mass mailings. They can target small clusters of people who fulfill specific criteria like warranty expiration, recent website engagement, birthdays, and more. When coupled with adept personalization, these triggered messages transform into authentic one-on-one communications.

With twice-a-year increments in postage rates, senders should explore methods to decrease their postage expenses. Mailing experts are consulted by marketers to guide streamlining mailing lists, consolidating mailings, or employing alternative tactics to curtail postage expenditure, all while maintaining a satisfactory return on investment for their mail campaigns.

Key direct mail statistics as of 2023:

- More than 91% of promotional mail is both accessed and opened.

- Among various communication mediums, direct mail garners the highest Return on Investment (ROI) at 112%, closely followed by SMS at 102%, email at 93%, and paid search at 88%.

- The integration of digital and direct mail strategies resulted in a 63% increase in response rates, a 68% surge in website visits, and a 53% boost in lead generation.

- Americans display the greatest comfort level when it comes to receiving direct mail, surpassing other advertising channels like television and social media advertisements.

- Marketers typically allocate a budget ranging from USD 100 to USD 500 per individual for direct mail campaigns.

- A significant 71% of consumers perceive direct mail as more personalized compared to online digital communication.

Directly mailing promotional material remains an effective method for engaging specific audiences, and its significance for enterprises will persist. Marketing professionals will integrate direct mail into their comprehensive marketing strategies. Despite potential obstacles such as inflation or disruptions in the supply chain, organizations will likely persist in leveraging tangible mail to entice and nurture potential leads, given its track record of yielding favorable outcomes.

Direct Mail Services Sourcing Intelligence Highlights

- Suppliers in the category could include paper manufacturers, printing equipment providers, and postal services. The bargaining power of suppliers could be moderate, as there are various suppliers available, but the industry's dependence on quality materials and efficient delivery could provide suppliers with some leverage.

- Labor, equipment and tools, rent and utilities, sales and marketing, and general and administrative are among the key costs incurred in the direct mail services category.

- The expense of direct mail items can vary widely, ranging from USD 0.30 to over USD 10 per recipient. The prices are contingent on factors such as expenditure on design, marketing content, mailing lists, printing, and distribution. Several entities and businesses handle a significant portion of these tasks internally, leading to expenses limited to printing and mailing charges.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Legal Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Insurance Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Direct Mail Services Procurement Intelligence Report Scope

- Direct Mail Services Category Growth Rate: CAGR of 3.1% from 2023 to 2030

- Pricing Growth Outlook: 3% - 4% (Annually)

- Pricing Models: Full-service pricing, customization-based pricing, competition-based pricing

- Supplier Selection Scope: End-to-end service, customization offered, cost and pricing, compliance, service reliability, and scalability

- Supplier Selection Criteria: Customization option, quality of printing, services offered, mailing list services, technology and tools used, track record and reputation, regulatory compliance, and others

- Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

- Vistaprint

- PsPrint

- PostcardMania

- Gunderson Direct Inc.

- Next Day Flyers

- Cactus Mailing Company

- Modern Postcard

- Mail Shark

- 48HourPrint

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions