Debt can be overwhelming, but residents of Minnesota have options that can lead to real relief. Understanding the specifics of debt settlement in Minnesota and the local laws that govern these processes can offer a pathway out of financial distress. This guide delves into how Minnesotans can navigate debt settlement strategically, with an emphasis on the legal frameworks that support these efforts.

Leveraging Debt Settlement in Minnesota for Financial Relief

Individuals have the ability to negotiate with their creditors in order to pay off their debts for a sum that is less than the total amount that is owed. This is possible through the Debt Settlement Minnesota program. People who are experiencing substantial financial difficulties and are trying to avoid the consequences of filing for bankruptcy may find this approach to be very advantageous, given their circumstances. By settling their obligations, individuals have the opportunity to potentially reduce their overall debt load, limit the impact on their credit score, and begin over on a more stable financial foundation.

Understanding Minnesota’s Consumer Protection Laws

Minnesota’s commitment to protecting consumers includes robust laws that regulate the practices of debt settlement companies. These laws are designed to prevent deceptive practices and ensure that debt relief agencies operate transparently and fairly. Knowing these protections can empower consumers to make informed decisions about engaging with debt settlement services and safeguard them from potential scams.

The Benefits and Risks of Debt Settlement

While debt settlement can provide much-needed relief, it’s important to consider both the benefits and the risks. Successfully negotiated settlements can significantly reduce one’s debt, but this process can also lead to temporary decreases in credit scores and potential tax liabilities on forgiven debts. It’s crucial to weigh these factors carefully and consult with a professional to understand all potential outcomes.

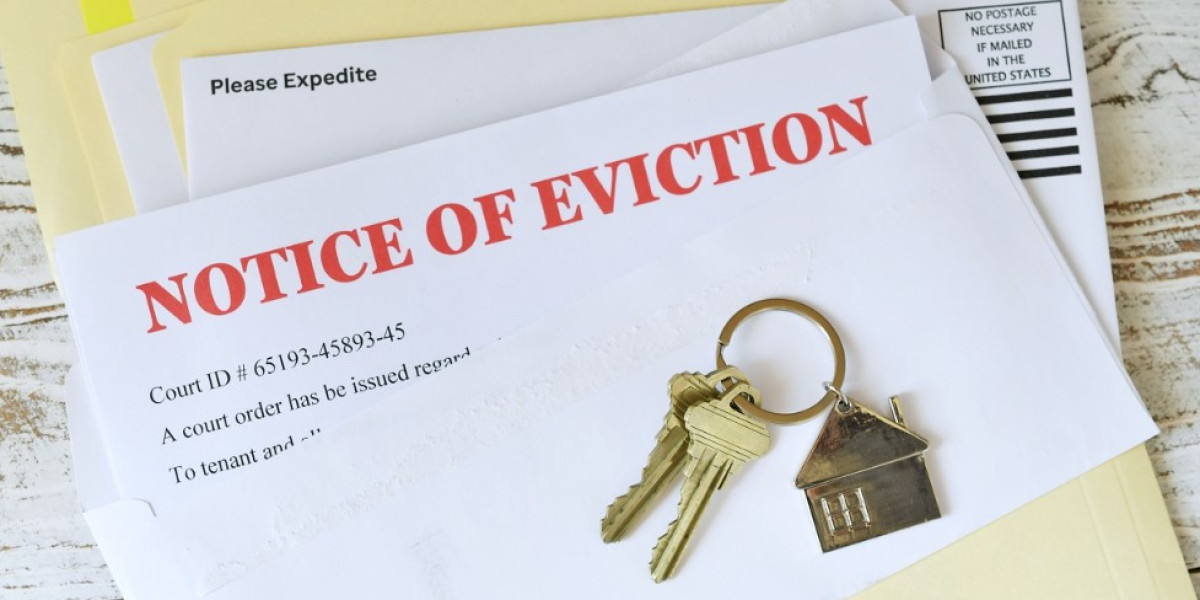

Adhering to Minnesota Debt Settlement Law

Navigating the intricacies of Minnesota debt settlement law requires a detailed understanding of legal rights and obligations. These laws set forth the guidelines under which debt settlement can occur, including specific protections like prohibitions against excessive fees and regulations ensuring agencies act in good faith. For those unfamiliar with these legal landscapes, working with a knowledgeable attorney can be invaluable.

Conclusion

For individuals seeking to navigate the complexities of debt settlement in Minnesota, professional guidance is essential. The experts at phillipslawmn.com specialize in Minnesota debt settlement law, providing the support and advice necessary to achieve favorable settlements. With their comprehensive understanding of the legal nuances and dedication to client success, Phillips Law can help you resolve your debts in a way that positions you for future financial stability.