Outplacement Services Procurement Intelligence

The outplacement services category is anticipated to witness growth at a CAGR of 7.0% from 2024 to 2030. Global outplacement broadens the scope of regional outplacement programs to assist businesses with personnel dispersed over vast geographic areas. In the current era of remote work and fragmented labor forces, global outplacement aids companies in offering assistance to their employees regardless of their location. Many players in the category offer their services in a hybrid manner. They offer their solutions virtually / online, enabling access to the services to the employees (the takers) at their convenience and from the comfort of their own homes. Nonetheless, programs are combined to provide on-demand face-to-face help with virtual delivery in nations where face-to-face interaction is still valued. Outplacement not only protects the brand image, but also saves the business enterprise from legal actions.

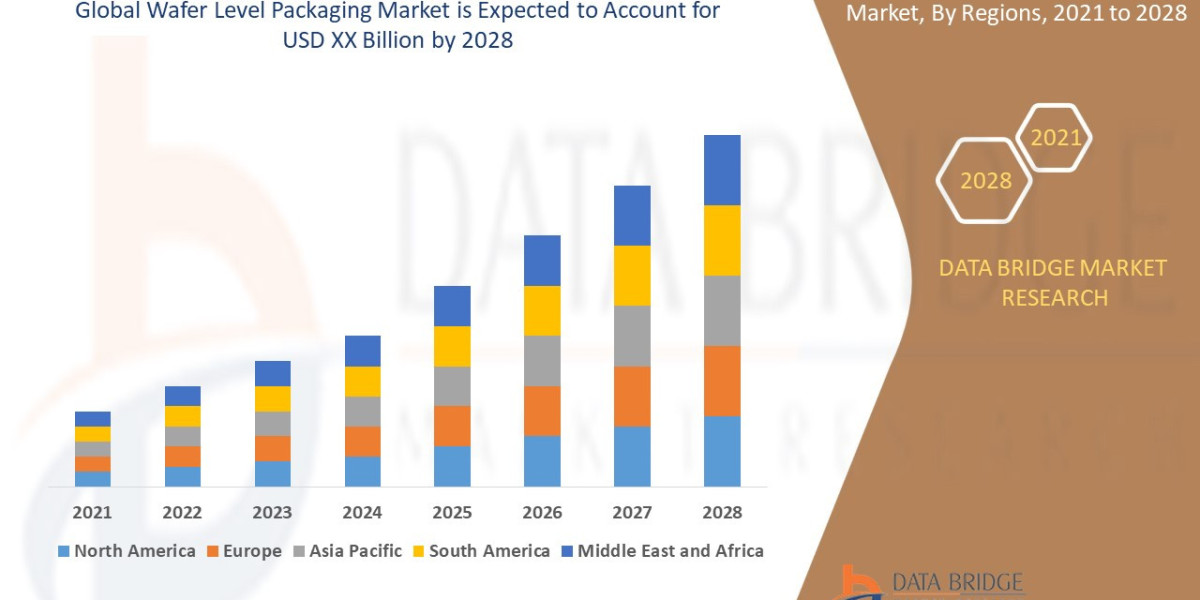

North America dominates the global category, followed by Europe and Asia Pacific. The high adoption of cutting-edge technologies combined with the presence of major competitors offers the industry plenty of room to grow in North America. Unavoidably, the United States in particular will continue to play a significant role. Any changes in the United States will have an impact on the overall outplacement services industry in the region. Europe follows North America, witnessing high demand for the services offered in the category from various nations. In Asia Pacific, Singapore, India, Japan, and China are among the leading nations. Offering outplacement services to departing employees will have a positive impact on the brand image of various business enterprises that are based out of India.

Order your copy of the Outplacement Services category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

The integration of cloud, analytics, and blockchain are the key technologies that are witnessing higher adoption in addition to artificial intelligence (AI) and virtual career coaching platforms. With a cloud-based outplacement method, customers and participants can access career guidance from anywhere in the world. This transcends geographical limitations. Consequently, attendees can avoid wasting precious time by commuting to large cities for classes or meetings with coaches. Employees can access the same services that were previously limited to those big cities from any place. For instance, Randstad RiseSmart offers a cloud-based solution that makes use of human filtering, semantic search, and aggregation technologies to match job searchers with available openings as efficiently as possible. The service provides highly tailored employment leads along with additional job search resources.

Outplacement Services Sourcing Intelligence Highlights

- The global outplacement services category is fragmented in nature, exhibiting intense competition with the presence of large number of service providers both at global and regional level.

- Threat of new entrants in the category is low to moderate, considering the initial financial expenditure necessary to set up the infrastructure and efficiently and effectively processing enormous amounts of data.

- Singapore is the preferred best cost country for sourcing outplacement services suppliers. The nation's job market is expanding, and it is a worldwide economic powerhouse, with current employment rate of 66.2%.

- Labor, technology (hardware / software), rent & utilities, training & development, maintenance & support, and others are the major cost components of Outplacement Services category. Other costs can be further bifurcated into administrative fee, interest on loan, tax, certification, insurance, and employee bonus.

List of Key Suppliers

- Adecco Group AG

- Career Insight Group

- Careerminds Group Inc.

- Chiumento Limited

- Frederickson Partners

- Hays plc

- INTOO, LLC

- ManpowerGroup Global Inc.

- Mercer LLC

- Prima Careers Pty. Ltd.

- RiseSmart, Inc. (d.b.a. Randstad RiseSmart)

- VelvetJobs LLC

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Helium Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Outplacement Services Procurement Intelligence Report Scope

- Outplacement Services Category Growth Rate : CAGR of 7.0% from 2024 to 2030

- Pricing Growth Outlook : 5% - 10% increase (Annually)

- Pricing Models : Cost-plus pricing, bundled pricing

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Geographical service provision, industries served, years in service, employee strength, revenue generated, certifications, career coaching, e-learning / upskilling courses, social network integration, transition guides, job search, resume review, and alerts, technology support, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Explore Horizon, the world's most expansive Market Research Database

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions