Understanding VCCs

Definition of VCC

A Virtual Credit Card (VCC) is a digital payment card that is used for online transactions. Unlike a physical credit card, a VCC is generated electronically and typically includes a unique card number, expiration date, and CVV code.

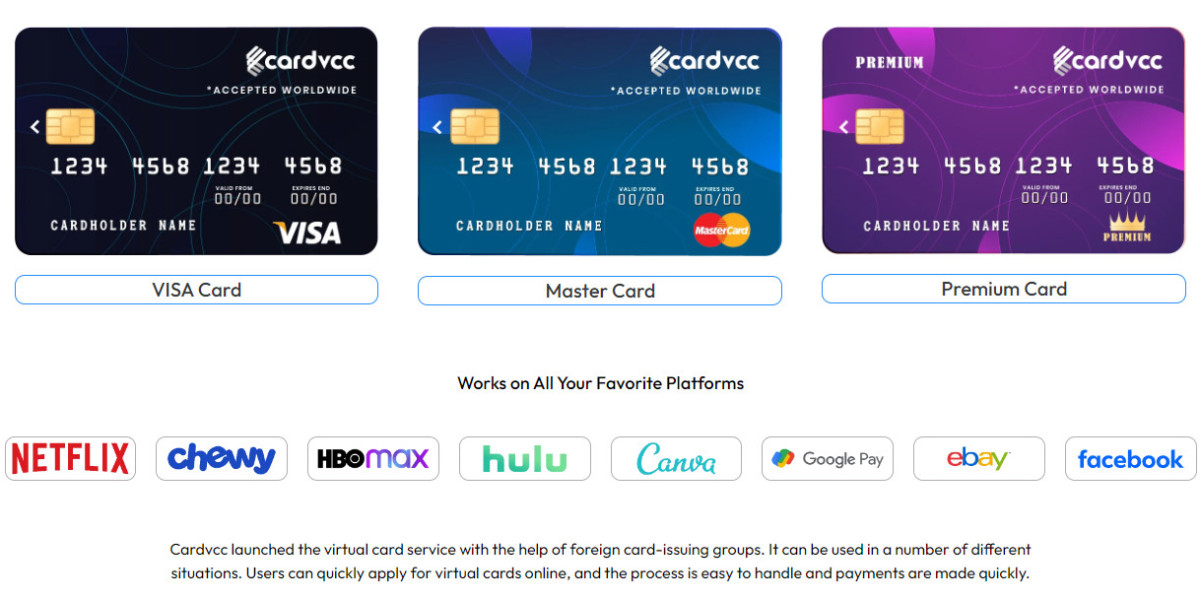

Types of VCCs

Prepaid VCCs

Prepaid VCCs are loaded with a specific amount of money and can be used until the balance is depleted. They are ideal for budgeting and preventing overspending.

Reloadable VCCs

Reloadable VCCs allow users to add funds as needed. They offer more flexibility compared to prepaid VCCs and are suitable for frequent online shoppers or businesses.

Advantages of Using VCCs

Enhanced Security

One of the primary benefits of VCCs is the enhanced security they offer. Since they are virtual, there is no physical card that can be lost or stolen. Moreover, VCCs can be set up for one-time use, minimizing the risk of fraud.

Privacy Protection

Using a vcc for sale helps protect your personal information. You don’t need to share your real credit card details when making online purchases, which reduces the risk of identity theft.

Global Acceptance

VCCs are widely accepted by most online merchants around the world. This makes them a convenient option for international transactions.

Budget Management

With a VCC, you can control your spending by loading only a specific amount of money onto the card. This helps in managing your budget and avoiding unnecessary expenses.

Common Uses of VCCs

Online Shopping

VCCs are perfect for online shopping. They provide a secure way to pay without revealing your actual credit card information.

Subscriptions

Many people use VCCs to manage subscription services like streaming platforms, software licenses, and more. This helps in keeping track of recurring payments and canceling subscriptions easily when needed.

Travel Bookings

Booking flights, hotels, and other travel services online is safer with a VCC. It provides an extra layer of security and peace of mind when traveling abroad.

Business Transactions

Businesses often use VCCs for online transactions to keep their financial information secure and manage expenses efficiently.

How to Purchase a VCC

Choosing a Reliable Provider

Selecting a reputable VCC provider is crucial. Look for providers with positive reviews, strong security features, and good customer support.

Steps to Buy a VCC

- Research and select a VCC provider.

- Sign up for an account on their platform.

- Choose the type of VCC you need (prepaid or reloadable).

- Load funds onto the VCC.

- Start using your VCC for online transactions.

Understanding the Costs

Be aware of the costs associated with VCCs. Some providers charge fees for card issuance, reloads, or transactions. Make sure to read the terms and conditions to avoid any surprises.

Top Providers of VCCs

Payoneer

Payoneer offers VCCs that are widely accepted and come with robust security features. They are ideal for freelancers and businesses that need to handle international payments.

Neteller

Neteller provides VCCs that are easy to use and reload. They are popular among online shoppers and gamers.

Entropay

Entropay offers prepaid VCCs that can be used globally. They are known for their high security and ease of use.

Other Notable Providers

Other providers like Skrill and EcoPayz also offer reliable VCC services with various features tailored to different needs.

VCCs for Business Use

Managing Business Expenses

VCCs help businesses manage expenses by providing a clear record of all transactions. This makes accounting easier and reduces the risk of fraud.

Safe Online Payments

Businesses can use VCCs to make safe online payments without exposing their main business accounts to potential risks.

Employee Benefits

Companies can issue VCCs to employees for business expenses, making it easier to track and manage spending.

Security Features of VCCs

Temporary Card Numbers

Many VCCs offer temporary card numbers that expire after a single transaction or a short period, significantly reducing the risk of fraud.

Fraud Protection

VCC providers often include advanced fraud protection features like transaction monitoring and instant alerts to detect and prevent unauthorized activities.

Transaction Alerts

Users can set up alerts for each transaction, keeping them informed of any activity on their VCCs and allowing them to act quickly if something suspicious occurs.

Limitations of VCCs

Expiration Dates

VCCs typically have expiration dates, which can be a hassle if you forget to use the balance before the card expires.

Limited Fund Availability

The amount you can load onto a VCC may be limited, which might not be suitable for large transactions.

Incompatibility with Some Merchants

While VCCs are widely accepted, some merchants may not accept them, especially for recurring payments.

How to Maximize the Benefits of VCCs

Regularly Monitor Transactions

Keep an eye on your VCC transactions to detect any unauthorized activities early.

Keep Track of Expiration Dates

Make sure to use your VCC balance before it expires to avoid losing any funds.

Use for Specific Purposes

Allocate VCCs for specific purposes like online shopping or subscriptions to keep your finances organized.

Future of VCCs

Innovations in VCC Technology

The technology behind VCCs is continually evolving, with new features being introduced to enhance security and convenience.

Growing Market Trends

The demand for VCCs is expected to grow as more people seek secure and private ways to make online transactions.

Predictions for the Next Decade

Experts predict that VCCs will become even more integrated into digital wallets and payment platforms, offering seamless and secure online transactions.

Case Studies

Success Stories of VCC Usage

Many businesses have successfully used VCCs to manage their expenses and secure their online transactions. For example, a small e-commerce business managed to reduce fraud by 70% after switching to VCCs for online payments.

Lessons Learned from VCC Failures

There are also lessons to be learned from VCC failures. For instance, a company faced issues with VCC expiration dates, leading to unplanned disruptions in their subscription services.

VCCs vs. Traditional Credit Cards

Key Differences

VCCs are digital and offer more security features compared to traditional credit cards. They are also easier to manage for online transactions.

Pros and Cons of Each

While traditional credit cards offer higher spending limits and broader acceptance, VCCs provide enhanced security and privacy for online transactions.

Legal Considerations

Regulations Surrounding VCCs

Different countries have different regulations regarding VCCs. It's important to understand the legal aspects in your region before using a VCC.

User Responsibilities

Users must ensure they use VCCs responsibly, keeping track of their transactions and adhering to the terms and conditions set by their provider.

Conclusion

Virtual credit cards offer a secure, convenient, and efficient way to manage online transactions. Whether you're a consumer looking to protect your privacy or a business aiming to streamline expenses, VCCs can be a valuable tool. By understanding their features, benefits, and limitations, you can make the most of what VCCs have to offer.