One of the common questions many crypto users, including beginners, have is: where are crypto coins actually stored?

If you have some knowledge about cryptocurrencies, you may know that cryptos are not stored in wallets.

Instead, wallets store the private keys that allow you to access and spend your crypto coins. So, where are these coins stored?

Understanding Crypto Coin Storage

Firstly, your crypto coins are not stored as files in a folder or anything like that. The way your crypto is stored depends on the type of blockchain used.

There are two main types of models: the UTXO-based model and the account-based model. Let’s dive into these to understand how each type stores your crypto coins.

UTXO-Based Blockchains

What is UTXO?

UTXO stands for Unspent Transaction Outputs. In this blockchain model, there are no balances stored on the blockchain.

Instead, the coins are stored as a list of unspent transaction outputs. This concept can be tricky, so let’s look at an example.

Example of a UTXO Transaction

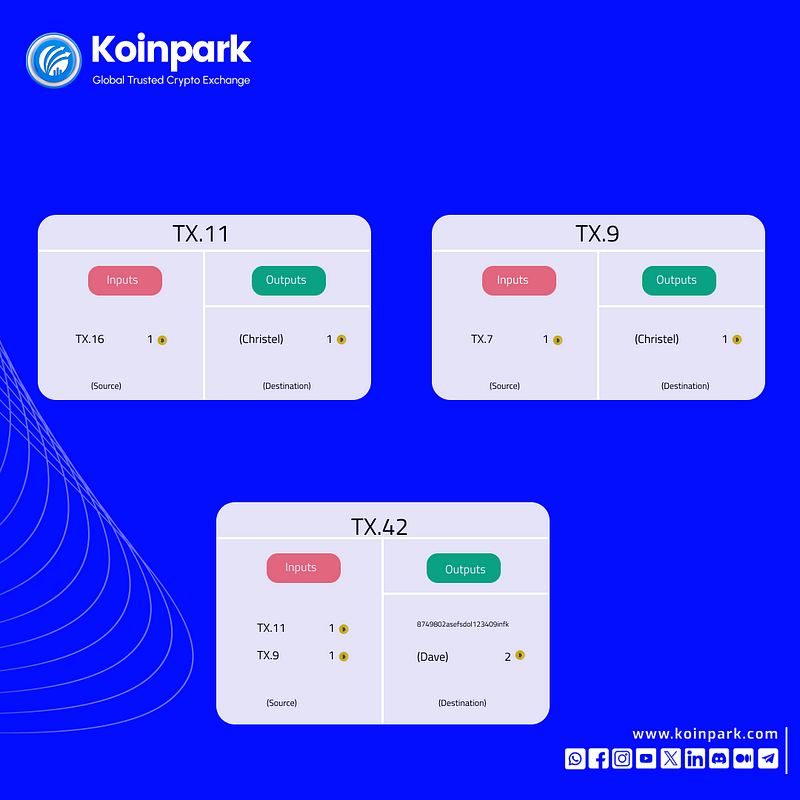

Imagine Christel wants to send two bitcoins to Dave. To prove he has these two bitcoins, Christel needs to link or refer to previous transactions where he received two bitcoins or more.

For example, Christel has received one bitcoin in transaction #11 and another bitcoin in transaction #9. If Christel hasn’t spent these bitcoins, he now has two unspent transaction outputs (UTXOs).

When Christel sends two bitcoins to Dave, these UTXOs are used as inputs in his new transaction.

The miners on the Bitcoin network verify that these outputs have not been spent before and then confirm the transaction. This leaves Dave with a UTXO for two bitcoins, which he can use in future transactions.

Understanding Wallet Balances

When you open your wallet, it scans the blockchain for any unspent outputs you own and adds them up to show your balance.

For example, if your balance is 10 bitcoins, it could be one UTXO for 10 bitcoins, two for five bitcoins each, or various other combinations.

Spending UTXOs

Each UTXO can be used only once in a transaction. Once it is spent, it is considered a spent output and cannot be used again.

For example, if you have a UTXO for five bitcoins and want to send two bitcoins, your five bitcoin UTXO will be used, and two new outputs will be created: one output to Christel for two bitcoins and another to a new address (change address) for the remaining 2.999 bitcoins.

When learning how to buy cryptocurrency, understanding how UTXOs work is crucial for managing your transactions efficiently.

Similarity to Cash Transactions

This process is similar to using cash. If you buy something for $50 and have a $100 bill, you give the cashier the $100 bill and receive $50 in change.

In UTXO blockchains, the change is automatically returned to you, ensuring no trust is needed between parties.

Using Multiple UTXOs

You can also use more than one UTXO in a single transaction. For instance, if you have a UTXO for 2.999 bitcoins and another for 2 bitcoins, and you want to send 4 bitcoins to Jessica, both outputs will be used, creating one output to Jessica for 4 bitcoins and a change output for 0.998 bitcoin (after the transaction fee).

Examples of UTXO Blockchains

Some examples of blockchains that use the UTXO model include Bitcoin, Bitcoin Cash, Litecoin, Dogecoin, and Cardano (which uses an extended UTXO model).

If you’re looking to explore these currencies on a Global Cryptocurrency Exchange, it’s essential to understand the UTXO concept.

Account-Based Blockchains

How Account-Based Blockchains Work

Account-based blockchains, like Ethereum, store accounts and balances directly on the blockchain.

When you make a transaction, such as sending 2 ETH to John, your account balance decreases by 2 ETH, and John’s balance increases by 2 ETH. There are no outputs or changes involved in this model.

Similarity to Bank Accounts

This model works similarly to how your bank account operates. You have a balance that you can add to or withdraw from as needed.

This model is considered the best way to buy crypto and manage your holdings efficiently.

ERC20 Tokens

For ERC20 tokens like Shiba Inu or Chainlink, the same principle applies. There are no actual coins stored anywhere; instead, there are just balances assigned to users’ accounts.

Advantages of Each Model

Simplicity

The account model is easier to understand for most users because people tend to think of their coins as balances in their accounts rather than unspent outputs.

This simplicity is beneficial when explaining How to buy Bitcoin in India or any other location.

Privacy

The UTXO model offers better privacy. When new, anonymous change addresses are created, they can be hard to link to a known owner, though advanced chain analysis techniques can sometimes trace them.

The account model makes it harder to trace the source of specific coins, which can be easier in UTXO-based systems.

Smart Contracts

The account model is better suited for smart contracts, making it easier for developers to work with accounts and balances.

Cardano is an exception, as it uses smart contracts with a UTXO model. Understanding these models can help when participating in Token Listing or other blockchain events.

Conclusion

We hope this article has given you a simplified idea of what crypto coins are and how they are stored.

Whether you’re dealing with UTXO-based or account-based blockchains, understanding the underlying mechanics can help you better manage and secure your crypto assets.

For those looking to trade, convert BTC to INR, or USDT to INR, knowing these fundamentals is crucial. Additionally, for beginners wondering How to buy your first Bitcoin, grasping these basics is a great starting point.