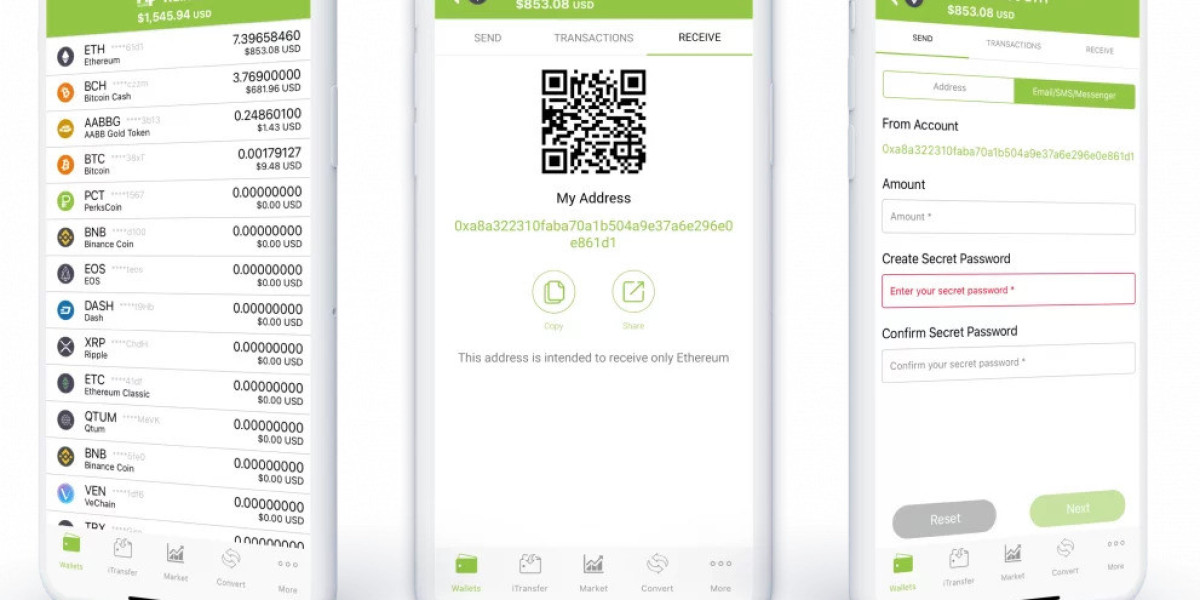

Tokenized securities, representing ownership of real-world assets such as stocks, bonds, and real estate on a blockchain, have emerged as a promising application of blockchain technology in the financial industry. White label crypto wallet development serve as essential tools for facilitating the issuance, management, and trading of tokenized securities, offering businesses a seamless and secure platform to access this burgeoning market. In this article, we explore how white label wallets are transforming the landscape of tokenized securities and driving innovation in the financial sector.

Tokenized Securities: Transforming Traditional Finance:

Tokenized securities leverage blockchain technology to digitize ownership rights and streamline the issuance, trading, and settlement of traditional financial instruments. By representing securities as digital tokens on a blockchain, tokenization offers numerous advantages, including increased liquidity, fractional ownership, 24/7 trading, and reduced intermediation costs. White label crypto wallets play a crucial role in enabling businesses to tap into the benefits of tokenized securities and unlock new opportunities in the financial markets.

Issuance and Management of Tokenized Securities:

White label crypto wallets provide businesses with the infrastructure needed to issue and manage tokenized securities efficiently. Issuers can use white label wallets to create, tokenize, and distribute securities on blockchain networks, leveraging smart contracts to automate processes such as dividend payments, corporate actions, and shareholder voting. By integrating tokenization features into white label wallets, businesses can streamline the issuance and management of securities, reducing administrative overhead and improving transparency.

Enhanced Compliance and Regulatory Oversight:

Compliance with regulatory standards is essential for tokenized securities to gain widespread acceptance and adoption in the financial industry. White label crypto wallets incorporate compliance features such as identity verification, investor accreditation, and regulatory reporting to ensure issuers and investors adhere to applicable securities laws and regulations. By integrating compliance measures directly into white label wallets, businesses can mitigate regulatory risks and build trust with investors and regulators.

Access to Global Investment Opportunities:

Tokenized securities unlock access to a diverse range of investment opportunities, allowing investors to gain exposure to assets from around the world without the traditional barriers of geography, currency, and jurisdiction. White label crypto wallets enable investors to trade tokenized securities seamlessly on global exchanges and marketplaces, providing liquidity and price discovery for a wide range of assets. This globalization of investment opportunities democratizes access to capital markets and fosters financial inclusion on a global scale.

Fractional Ownership and Asset Fractionalization:

Fractional ownership is a key feature of tokenized securities, allowing investors to purchase and trade fractional shares of high-value assets such as real estate, art, and private equity. White label crypto wallets facilitate asset fractionalization by enabling investors to buy and sell tokenized securities in smaller denominations, opening up investment opportunities to a broader audience. This democratization of ownership democratizes access to assets that were previously inaccessible to retail investors.

Secondary Market Trading and Liquidity Provision:

White label crypto wallets empower investors to trade tokenized securities on secondary markets, enhancing liquidity and price discovery for tokenized assets. By integrating with decentralized exchanges (DEXs) and liquidity pools, white label wallets enable investors to buy, sell, and trade tokenized securities peer-to-peer, without the need for traditional intermediaries. This democratization of secondary market trading creates a more efficient and liquid market for tokenized securities, benefiting both issuers and investors.

Integration with Decentralized Finance (DeFi) Protocols:

White label crypto wallets are increasingly integrating with decentralized finance (DeFi) protocols to provide users with access to a wide range of financial services such as lending, borrowing, and yield farming. By incorporating DeFi features into white label wallets, users can unlock additional value from their tokenized securities, such as earning interest on idle assets or using them as collateral for loans. This integration of DeFi protocols enhances the utility and versatility of tokenized securities, creating new avenues for value creation and financial innovation.

Future Trends and Outlook:

The future of white label crypto wallets in tokenized securities is bright, with continued innovation and growth expected in the coming years. Key trends to watch include the integration of artificial intelligence (AI) and machine learning (ML) technologies for asset tokenization and risk management, the expansion of interoperability with cross-chain solutions, and the emergence of decentralized autonomous organizations (DAOs) for governance and decision-making. As the tokenized securities market matures and evolves, white label wallets will play a central role in driving innovation and unlocking the full potential of blockchain technology in the financial industry.

Conclusion:

White label crypto wallets are revolutionizing the way tokenized securities are issued, managed, and traded, offering businesses and investors a seamless and secure platform to access global investment opportunities. By leveraging blockchain technology, compliance features, and integration with DeFi protocols, white label wallets empower users to participate in the tokenized securities market with confidence and ease. As the adoption of tokenized securities continues to grow, white label wallets will remain indispensable tools for businesses seeking to capitalize on the benefits of blockchain-based finance and unlock new opportunities in the digital asset economy.

Search

Popular Posts

-

High Class Call Girls Services in Faridabad | Faridabad Call Girls | Call Girls in Faridabad

By Tina Kapoor

High Class Call Girls Services in Faridabad | Faridabad Call Girls | Call Girls in Faridabad

By Tina Kapoor -

pafijawatimur

pafijawatimur

-

gestunbet gestunbet gestunbet gestunbet gestunbet gestunbet gestunbet gestunbet gestunbet gestunbet

By lpo888b

gestunbet gestunbet gestunbet gestunbet gestunbet gestunbet gestunbet gestunbet gestunbet gestunbet

By lpo888b -

Cryptocurrency yang Membawa Sentuhan Kemanusiaan ke Dunia Digital

Cryptocurrency yang Membawa Sentuhan Kemanusiaan ke Dunia Digital

-

Backlink Profil Strategi Penting bagi Situs Judi Online

Backlink Profil Strategi Penting bagi Situs Judi Online