Advanced Driver Assistance Systems (ADAS) Industry Size, Share, Trends & Growth Analysis by 2030

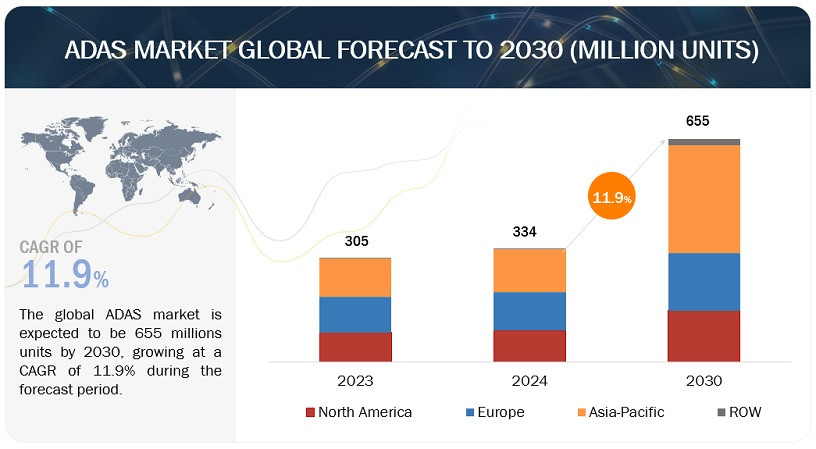

The global ADAS industry size is projected to grow from 334 Million units in 2024 to 655 Million Units by 2030, at a CAGR of 11.9%. The ADAS industry is experiencing robust growth due to the increasing integration of advanced driver-assistance systems, connected vehicles, autonomous driving features, and government mandates. Additionally, increasing standards for safer vehicles with new technological developments from ADAS solution providers will boost the revenue growth for ADAS during the forecast period.

Based on Vehicle Class, China, South Korea, and Japan account for the largest share of the ADAS industry in the Asia Pacific region. The market growth in Asia Pacific can be attributed to the high vehicle production and increased use of advanced electronics in Japan, South Korea, and China. These countries’ governments have recognized the automotive industry’s growth potential and have consequently undertaken various initiatives to encourage major OEMs to enter their domestic markets. Several European and American automobile manufacturers, such as Volkswagen (Germany), Mercedes Benz (Germany), and General Motors (US), have shifted their production plants to developing countries. Major ADAS solution providers such as Robert Bosch (Germany), Continental (Germany), and Denso (Japan) have production facilities across the region. In October 2023, Denso Corporation announced that it would collaborate with KOITO MANUFACTURING CO., LTD. (Japan) to develop a system to improve the object recognition rate of vehicle image sensors at night. The solution is expected to work with coordinating lamps and image sensors, improving driving safety during nighttime.

Download PDF Brochure @ https://www.marketsandmarkets.....com/pdfdownloadNew.a

Based on Level of Autonomy: The ADAS industry is categorized into levels of autonomy ranging from L1 to L5. Advanced safety and connectivity features are significantly shaping innovations and trends within the automotive industry. Whereas automotive OEMs traditionally focused on mechanical components, emerging megatrends such as electric vehicles, autonomous driving, lightweight design, and connectivity have expanded the scope for ADAS utilization. With advancements in connectivity, enhanced engine performance, and infotainment systems, automotive suppliers are concentrating on integrating advanced electronics, sensors, and driver assistance features into vehicles. Governments worldwide are mandating the implementation of safety features in new vehicles to address issues such as speeding and reducing fatal accidents. For instance, the Indian Ministry of Road Transport and Highways has proposed a mandate for incorporating advanced safety technologies such as electronic stability control (ESC) and autonomous emergency braking (AE in vehicles manufactured between 2022 and 2023. The Indian Ministry of Road Transport and Highway emphasizes that advanced safety features should be standard across all vehicles in India rather than being limited to luxury models.

By Region: The North American region, encompassing the US, Canada, and Mexico, has been examined closely. Projections indicate significant growth in the ADAS industry within this region throughout the forecast period. Established North American OEMs like Ford Motors, General Motors, and Tesla, alongside well-established European and Asian counterparts such as Toyota (Japan), Nissan (Japan), Honda (Japan), Hyundai/Kia (South Korea), BMW (Germany), and Volkswagen (Germany), integrate ADAS features into their vehicles. In North America, the US predominantly leads the automotive industry, primarily due to the significant presence of major players like Ford Motors, General Motors, and Fiat-Chrysler Automotive. The US ADAS industry favors vehicles with advanced comfort and safety technologies. The emergence of autonomous vehicles stands out as a pivotal trend within the North American ADAS industry. Numerous firms are actively engaged in creating self-driving cars, necessitating sophisticated ADAS systems. The increasing interest in autonomous vehicles is anticipated to propel ADAS industry expansion in the foreseeable future as further technological advancements are made and incorporated into vehicles. Additionally, government regulations mandating the adoption of these technologies are expected to contribute to market growth.

Key Players

The ADAS industry is dominated by global players such as Robert Bosch GmbH (Germany), Continental AG (Germany), ZF Friedrichshafen (Germany), Denso (Japan), and Magna International (Canada), among others. These companies adopted new product development strategies, expansion, partnerships & collaborations, and mergers & acquisitions to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.....com/requestsampleNew